Reforms to the Non-Dom regime from April 2025

xx

This guide will outline the key changes and actions you can consider.

Explore your options, with a no-obligation financial planning consultation.

Book A DemoKey planning actions

As of April 2025, Inheritance Tax (IHT) rules will undergo significant changes, affecting non-domiciled individuals who live in the UK. Here’s an overview to help you understand how the new rules may impact your estate and any trusts you have.

Current Rules vs. New Rules from April 2025

Current System

- IHT liability is based on domicile status

- Non-UK domiciled individuals only pay UK IHT on UK-based assets

- Long-term UK residents (15 out of the last 20 years) are considered “deemed domiciled” and are subject to UK IHT on worldwide assets

Changes from April 2025

- Domicile will no longer determine IHT. Instead, residency status will dictate IHT obligations.

- Long-Term Residents (LTRs): Anyone who has been UK-resident for 10 of the last 20 years will be considered a “long-term resident” (LTR) and liable for IHT on worldwide assets, similar to UK domiciled individuals.

Key Points for Trusts and Excluded Property

- Trusts Set Up by Non-Domiciles Before April 2025

Non-UK assets placed in trusts before April 2025 are considered “excluded property,” meaning they remain outside the UK IHT scope. However, this benefit might change if the trust creator becomes an LTR. - Trusts Set Up by LTRs Post-2025

If an LTR establishes a trust, the trust assets (even if held overseas) may fall under UK IHT rules. Trust assets may incur charges:- At the trust’s tenth anniversary: If the settlor is an LTR, periodic charges may apply.

- Upon the settlor’s death: Assets in the trust could be taxed as part of the estate if the settlor is a potential beneficiary.

- Shifting Residence Status

Assets may enter and leave the IHT net depending on whether the settlor remains an LTR. For example, if you retire abroad and lose LTR status, your trust assets may move outside the IHT net again, possibly triggering exit charges. - Exceptions

- Trusts set up by non-domiciles before April 2025 may retain “excluded property” status if the settlor passes away before April 2025.

- If the settlor was an LTR at death, the trust may still be subject to periodic charges.

Other IHT Considerations

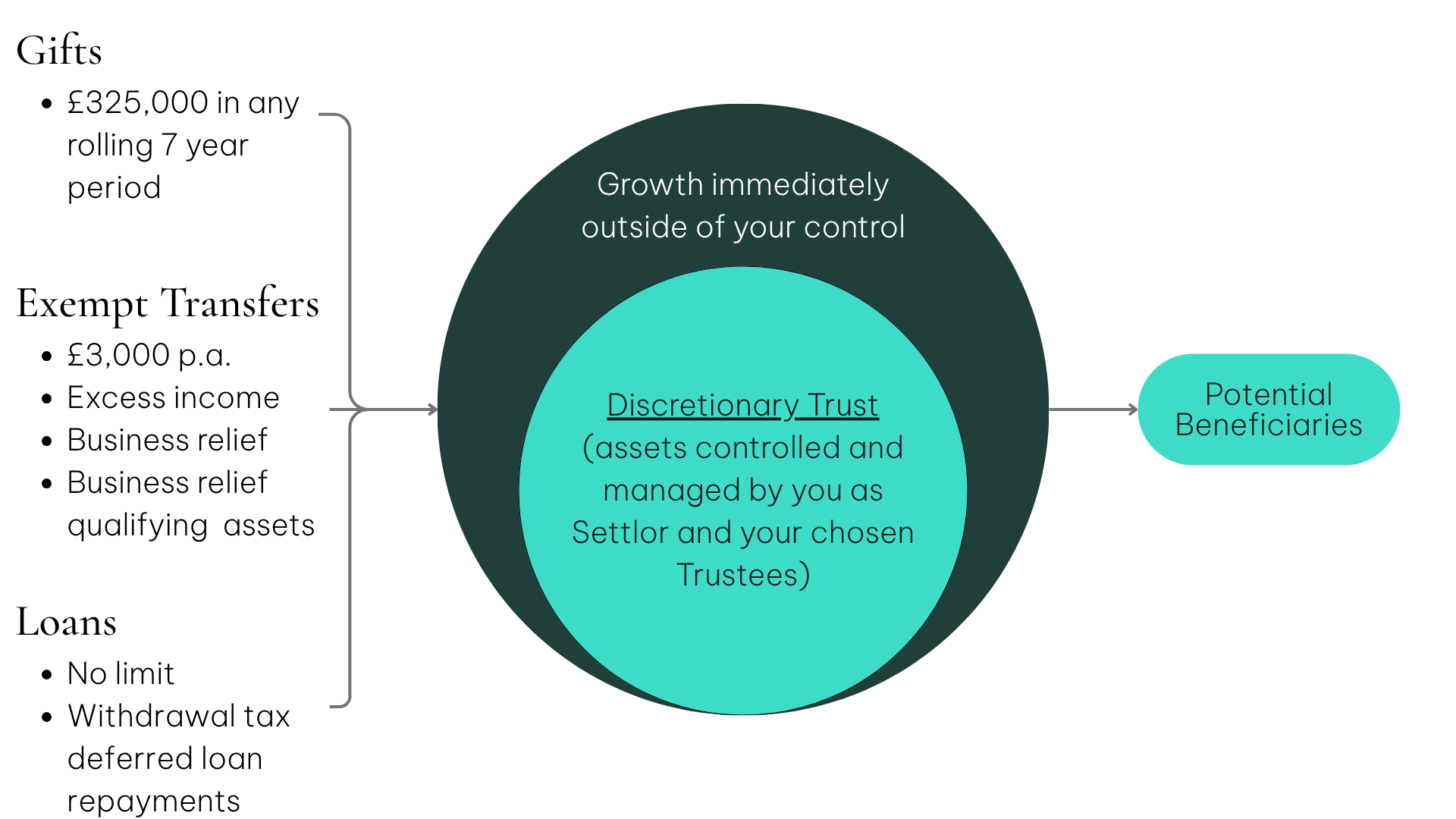

- Lifetime Transfers: Gifts or transfers of foreign assets made by a non-LTR are generally exempt from UK IHT. However, if the transferor later becomes an LTR, some assets may fall back within the scope.

- Spouse Exemption: A non-domiciled spouse may choose to be treated as UK domiciled to benefit from an unrestricted spouse exemption. This election remains but with a longer exit period (10 years) post-2025.

Summary

The upcoming IHT changes aim to simplify rules but may complicate trust management for LTRs. Non-domiciled individuals should review estate plans and discuss any trusts with advisors to mitigate unexpected tax implications as their residence status shifts.

xx

xx

Still have questions?

Following the biggest set of tax increases in modern history, it’s an opportune moment to evaluate your family’s financial situation and objectives.

We encourage you to contact us, to ensure you are fully utilising all available allowances this year, and that you are adequately protected from risk, as far as possible, including any risk resulting from these changes.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.