Tax optimisation for income & assets

Your control is our priority.

Introduction

Many high-net-worth investors don’t think about the tax efficiency of their investments until the end of the tax year approaches in April. But it shouldn’t be a once-a-year job.

Over a lifetime, careful tax planning can significantly boost your wealth, and the most effective tax planning comes from thinking about tax every time you make an important financial decision.

So, whether you’re just starting out, retired or somewhere in between, take advantage of the reliefs and allowances available to you. Here are seven tax planning tips to make your money work much harder.

Need a bespoke financial plan crafted specifically for your unique requirements?

Book a DemoMaximise your allowances

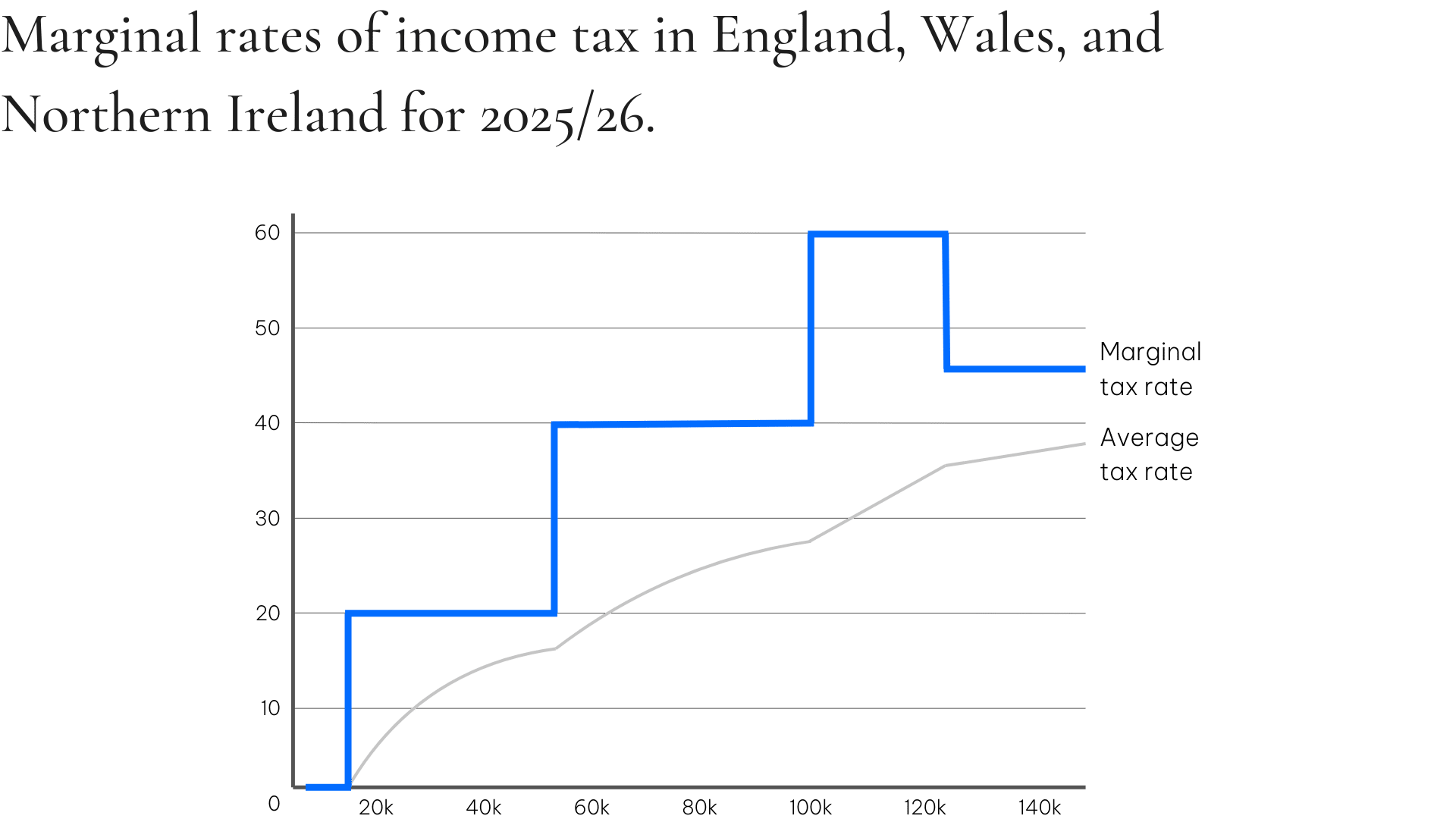

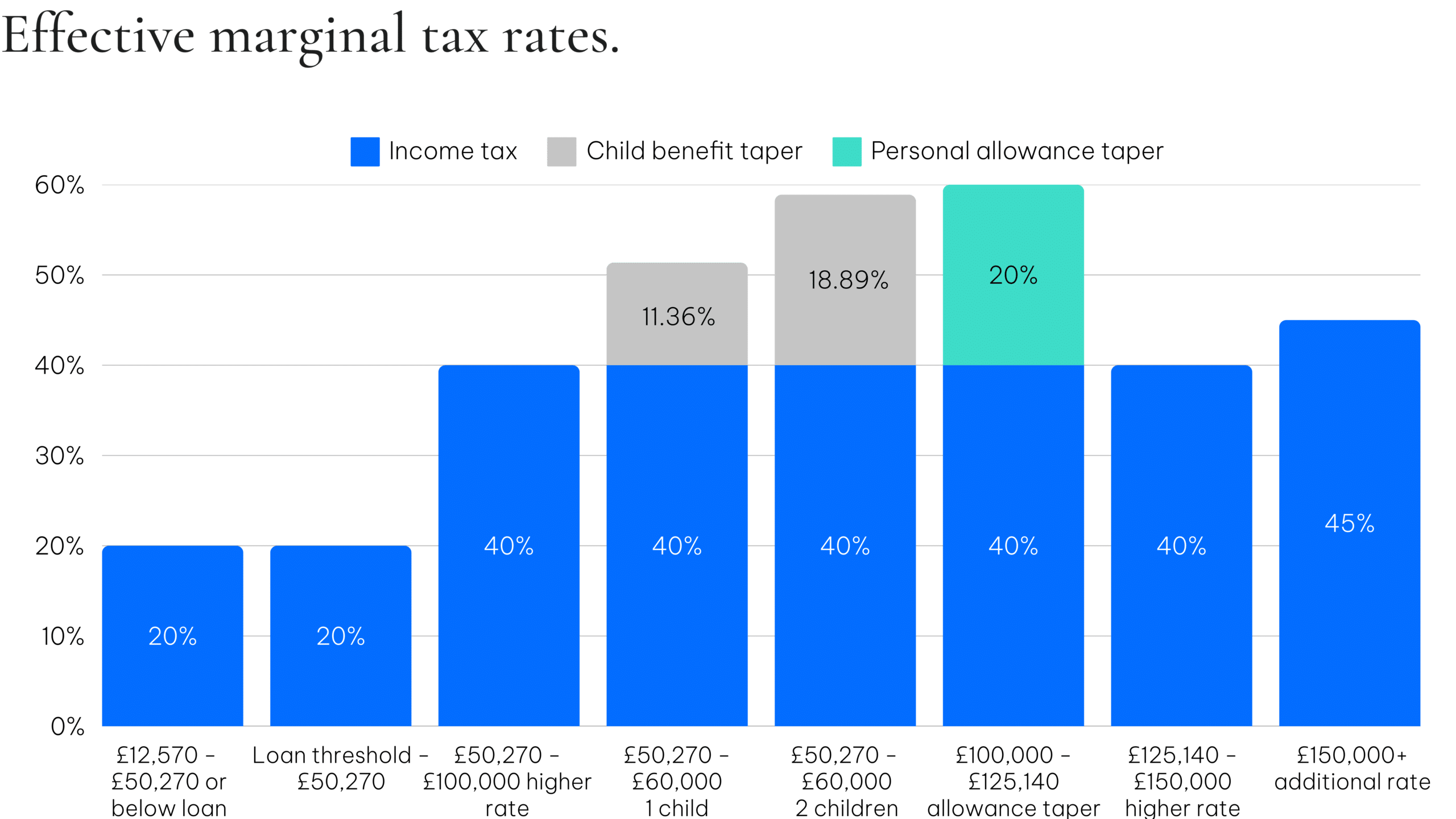

If you’re earning over £100,000 a year, you need to pay close attention to tax, as you could end up paying 60% Income Tax.

The income tax personal allowance for higher earners reduces by £1 for every £2 earned over £100,000 and creates an effective tax rate of 60% for earnings between £100,000 and £125,140.

This tax trap is easy to mitigate, though – by boosting your pension contributions, you can not only bring your taxable income down below £100,000, but you can also get that additional contribution topped up by 40% government tax relief and, potentially, employer contributions.

Read more about the 60% Tax Trap.

Anything above the basic rate of tax must be claimed via the individual’s tax return.

Pensions are a key factor to consider when optimising your tax year planning and it’s important to remember the tax relief you get by paying into a pension.

Basic rate taxpayers get government tax relief at 20%, which means it only costs £800 to invest £1,000.

Higher rate taxpayers get 40% tax relief on pension contributions. This means it only costs them £600 to invest £1,000.

And additional rate taxpayers enjoy 45% tax relief on pension contributions, with a £1,000 contribution only costing £550 in real terms.

If you haven’t been making contributions for a while or receive a lump sum, you can carry forward your unused pension allowance from the previous three tax years and still receive tax relief of up to 45% depending on your current and previous income.

Anything above the basic rate of tax must be claimed via the individual’s tax return and the above examples assume that you have then invested the additional tax relief claimed.

If you’re fortunate enough to be sitting on cash in savings accounts – including Cash ISAs – think about making it work harder.

Left in a savings account, your money will generally earn less interest, despite the Bank of England’s recent rate hikes. Over time, the real value of your money will be eroded by inflation. There are also limits on the amount of interest you can earn tax-free each year; £1,000 for basic rate taxpayers, £500 for higher rate taxpayers, and zero for those paying the additional rate. And in the long-term, it’s unlikely to get you much closer to achieving a financial goal – whether that’s saving for a house deposit, the trip of a lifetime or your retirement.

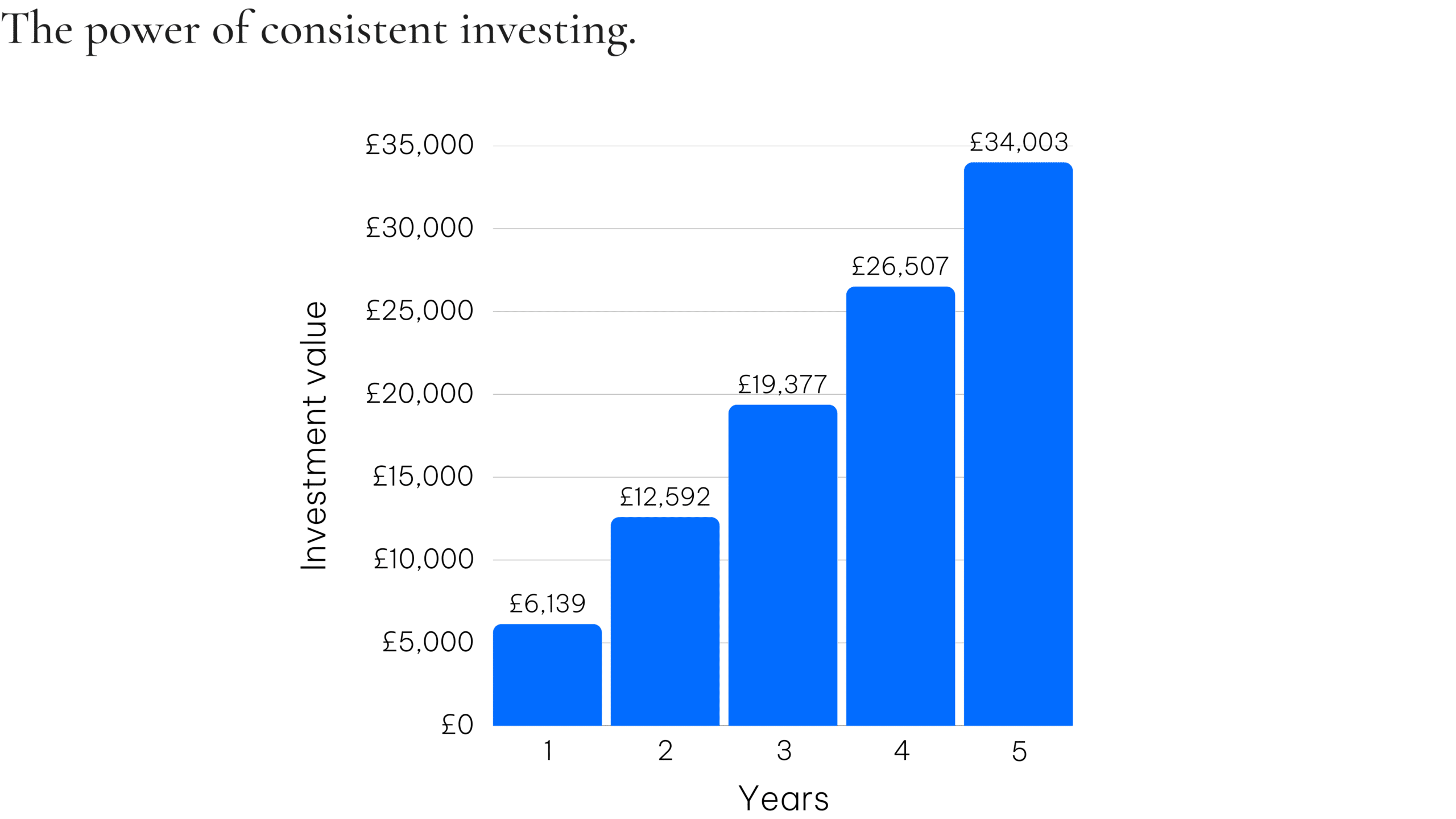

You have more potential to benefit from investing in a Stocks & Shares ISA. Of course, it needs to be money you can afford to tie up for five years-plus. But over time it should give you more bang for your ISA buck.

Assuming a consistent growth rate of 5% per annum net of fees, just £500 a month paid into a Stocks & Shares ISA could amount to £34,000 after five years.*

*The figure is an example only and not guaranteed. It is not a minimum or maximum amount. What you get back depends on how your investment grows and the tax treatment of the investment. You could get back more or less than this. An investment in a Stocks & Shares ISA does not provide the security of capital associated with a deposit account or Cash ISA with a bank or building society.

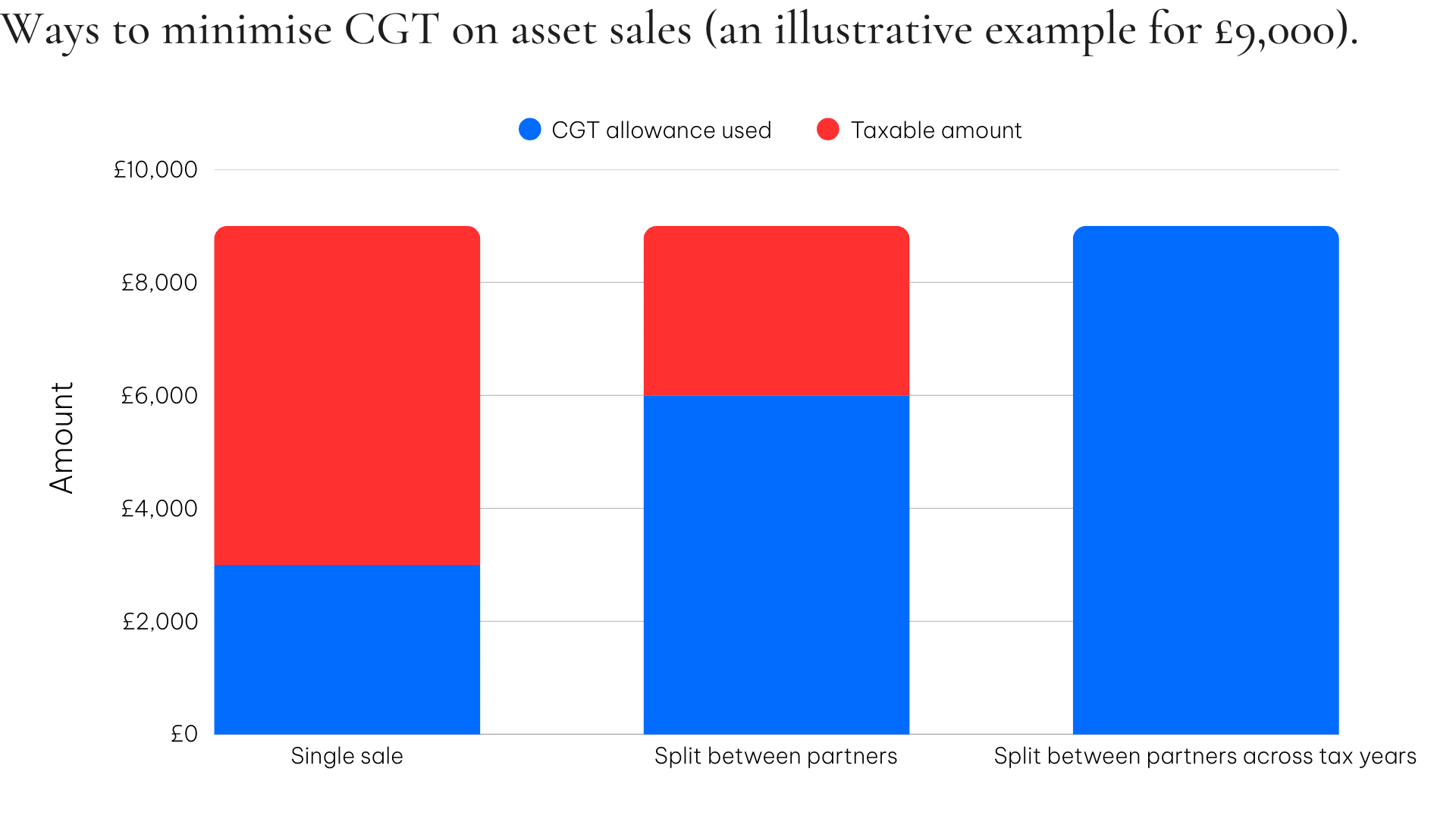

At some point, you may want to sell an asset at a profit. This could be anything from a second home to stocks and shares – or even valuable items such as jewellery or antiques. However, unless you’re holding them in an ISA, if you make a gain over £3,000, you could be liable for Capital Gains Tax (CGT).

There are ways you can cut your bill though. One is to give half of your holding to your partner, enabling you both to use your £3,000 CGT allowance – although this can be complicated so it’s worth seeking expert advice.

If that’s not an option, you can always try selling shares in two stages – March and April – enabling you to straddle two tax years.

A basic rate taxpayer will pay 18% tax on gains over £3,000, while higher-rate and additional rate taxpayers incur a 24% charge, in the 2025/26 tax year.

If you run your own business and pay yourself using a combination of salary and dividends, or you hold shares in another company, it’s important to be aware that in April 2024 the allowance for tax free dividends halved, from £1,000, to only £500. The tax on dividends above this is 8.75% for basic-rate taxpayers, 33.75% for higher-rate taxpayers and 39.35% if you pay the additional rate of Income Tax.

So, if you’re earning any dividends outside a tax wrapper, consider putting them into a Stocks & Shares ISA if you haven’t already. Then no tax will be payable on any capital in your ISA or the income it generates.

Your 50s and 60s can be an expensive period – you may want to help children out financially, do work on your home or see the world. Your pension might be a tempting pot of cash now that you can access it from age 55. But while dipping into your pension might be easy, it could cost you a fortune in tax.

Only the first 25% of any withdrawal is paid tax free; the remaining 75% will be added to your income for the year and taxed at your marginal rate. It may even bump you up a tax bracket and make you a higher or additional-rate taxpayer overnight.

Given the current economic uncertainty, financial contributions you make to your children are more valued than ever. But did you know your gift will not only help them out, but it could also save your future beneficiaries Inheritance Tax.

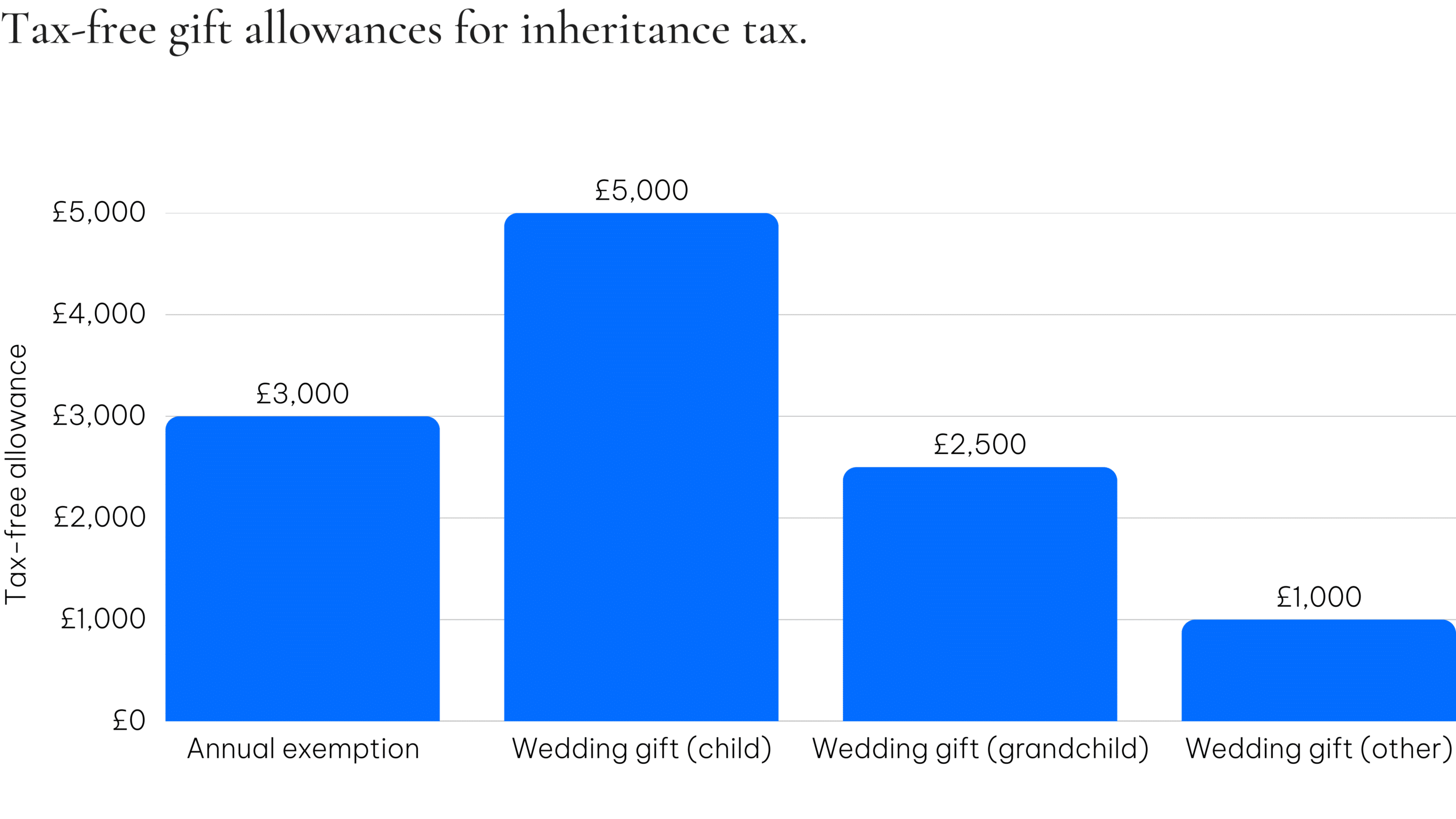

You can give away up to £3,000 of money or gifts each tax year without it being included in your estate for Inheritance Tax purposes – this is your ‘annual exemption’.

In additional to that, every tax year you can give a tax-free gift to someone getting married or entering a civil partnership. For a child you can gift £5,000, while the limit is £2,500 for a grandchild or £1,000 for anyone else. If you are giving to the same person, you can combine your annual exemption and wedding gift.

These allowances are per person, which means a couple could potentially give their child £16,000 tax free as a gift.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax relief generally depends on individual circumstances.