Inheritance Tax (IHT) & Estate Planning: Navigating the changes

The UK’s inheritance landscape is shifting – and the changes arriving in April 2027 could reshape how your wealth is taxed and passed on.

For the first time, pensions will be pulled into your estate for Inheritance Tax purposes. That means what was once ring-fenced may now face a 40% hit before it reaches your loved ones.

In this exclusive client webinar, our estate planning specialists will guide you through:

✅ What the 2027 pension changes really mean for you

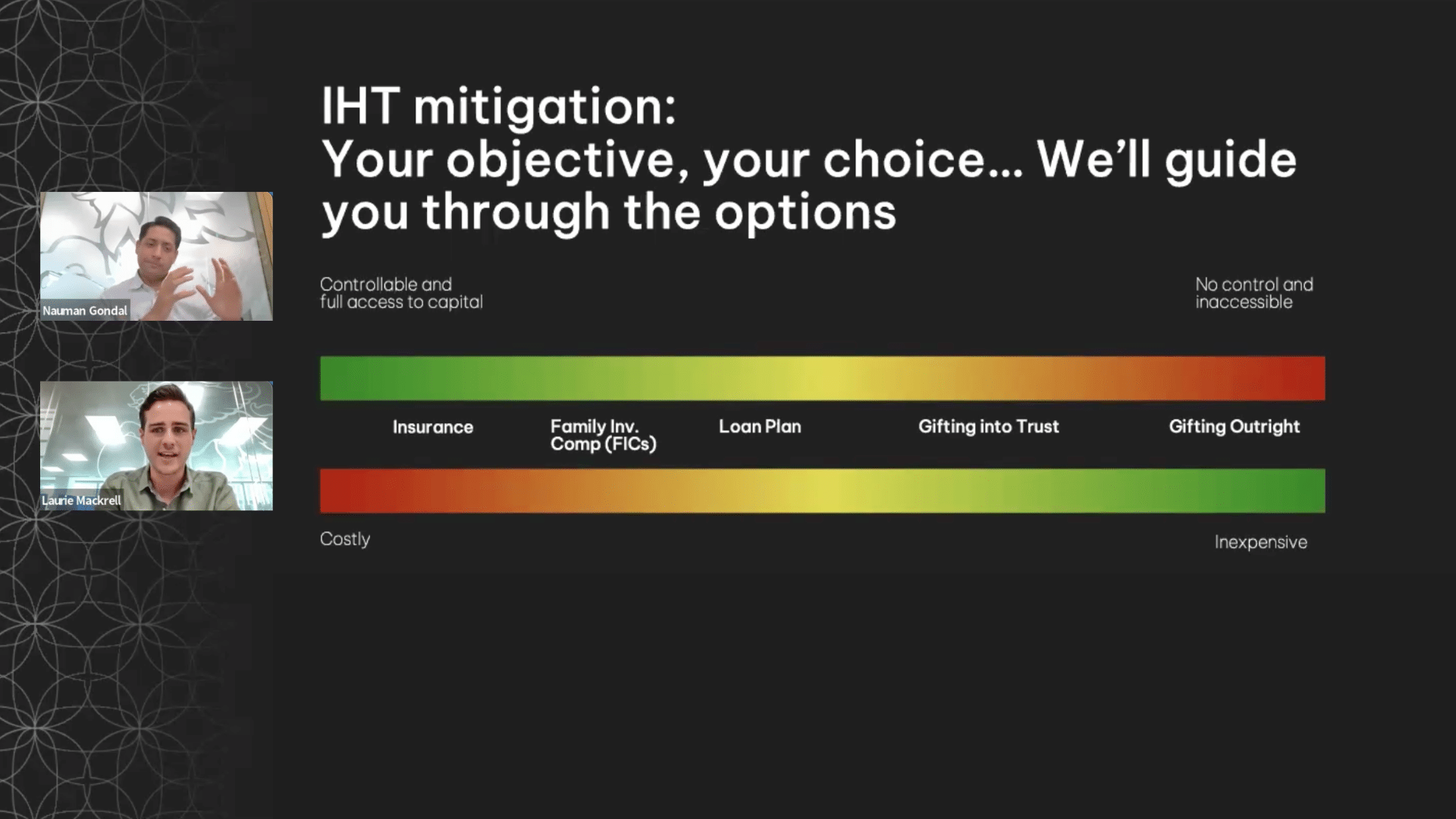

✅ How protection policies, like life cover written in trust, can help meet increasing IHT liabilities

✅ Smart structuring strategies to protect your family’s future

✅ How to integrate protection with your broader investment and retirement planning

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief depends on individual circumstances.

Trusts are not regulated by the Financial Conduct Authority.

SJP Approved 19/08/2025