Are you missing out on valuable tax allowances?

- Many high-earning individuals could be leaving money on the table, because they’re not fully utilising the tax allowances and reliefs available to them each tax year.

- If you’ve already accumulated significant pensions and investments, there’s more to gain – and to protect – by leveraging every allowance and relief that’s available to you.

- It’s vital to act in good time, ahead of the 2025/26 tax year end. The last day is 5 April.

Secure your no-obligation Tax Year End health check with an expert wealth adviser.

Let’s get startedWork through your checklist, to ensure you’re utilising every tax allowance and relief available to you.

1. Maximise the use of your pension annual allowance: Contribute up to £60,000 to your pension. Note that tax relief on personal contributions is also restricted to the higher of 100% of earnings in the tax year, or £3,600.

2. Explore utilising unused annual allowances from the past three tax years through carry forward rules. You could, in theory, make a one-off contribution of up to £200,000, at a cost from as little as £110,000.

3. Review the total value of your pensions: Even post-Lifetime Allowance (LTA) abolition, consider whether you should grow your pension pot beyond £1 million, or save and invest elsewhere. An adviser can help you to determine the best course of action through sophisticated cashflow and net worth modelling. While you’re here, track down previous pensions to make sure you know the true overall value.

4. Leverage employer pension contributions: Ensure you’re maximising employer-matched contributions, and reduce taxable income through salary and bonus sacrifice.

5. Utilise your spouse’s allowance: If your spouse hasn’t used their annual allowance, or could carry forward from the previous three years, consider making contributions on their behalf.

6. Utilise your children’s allowances: Each child benefits from a £3,600 pension annual allowance – contribute up to £2,880 each year on their behalf and they’ll benefit from 20% ‘tax relief’ with a government top-up.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief is generally dependent on individual circumstances.

7. Use-or-lose your ISA allowance: Contribute up to £20,000 to your ISA for tax-efficient growth and income.

8. Use-or-lose your spouse’s ISA allowance, also, up to £20,000.

9. Junior ISAs for children: Invest up to £9,000 per child, benefiting from tax-efficient growth for their future.

10. Consider using a Lifetime ISA: Benefit from a 25% government top-up on contributions up to £4,000, if you’re under 50 (must be opened before you turn 40).

Please note Lifetime ISAs are not available through St. James’s Place.

11. Capital Gains Tax (CGT) allowance: Utilise the annual exemption (£3,000 per person for 2024/25) by realising gains before 5 April.

12. ‘Bed and ISA’ strategy: Sell investments to use your CGT exemption, then repurchase them in an ISA so they’re ‘wrapped’ going forward.

13. Offset capital losses: Use previous losses to offset gains, reducing CGT liabilities.

The value of an ISA with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief is generally dependent on individual circumstances.

14. Gift income to a spouse: Transfer income-generating assets to a lower-earning spouse to potentially reduce your overall tax liability – although such transfers must be on an ‘outright and unconditional’ basis.

15. Utilise your dividend allowance: Use the £500 tax-free dividend allowance before the tax year end.

16. Rental income optimisation: Deduct legitimate expenses, or transfer rental income to a spouse if advantageous.

17. Use your annual gifting allowance: Give up to £3,000 per person tax-free this year, with an additional £3,000 carry-forward from the previous year if unused.

18. Small gifts exemption: Make unlimited gifts of up to £250 per recipient.

19. Wedding/ civil partnership gifts: Gift up to £5,000 to children, £2,500 to grandchildren, or £1,000 to others.

20. Use Trusts for larger gifts: Shelter assets from potential inheritance tax liabilities using trusts.

21. Make regular gifts out of surplus income: These should be made for a consistent amount and frequency – and be affordable. Above all, they should be thoroughly documented.

22. Consider a Life Cover Plan: Write a Life Cover Plan into Trust, to pay towards eventual IHT liabilities.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief is generally dependent on individual circumstances.

Trusts are not regulated by the Financial Conduct Authority.

23. Maximise ‘Gift Aid’ donations: Claim income tax relief and reduce IHT liabilities by donating to charities.

24. Donate shares: Gift shares to charities to claim full income and CGT relief.

25. Marriage Allowance Transfer: Transfer up to 10% of your personal allowance to a lower-earning spouse.

26. Claim tax relief on professional fees: Deduct fees for professional memberships or subscriptions related to your job.

27. Check your Personal Savings Allowance (PSA) utilisation: Ensure interest income doesn’t exceed tax-free PSA thresholds (£1,000 for basic rate, £500 for higher rate, and zero for additional rate taxpayers).

28. Rent-a-Room Relief: Earn up to £7,500 tax-free by letting a furnished room in your home.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief is dependent on individual circumstances.

29. Tax-free childcare accounts: Contribute to an account to receive a government top-up of up to £2,000 per child.

30. School fee and university planning: Invest tax-efficiently to build funds towards your children’s or grandchildren’s education.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief is generally dependent on individual circumstances.

31. Maximise state pension contributions: Review your National Insurance record to fill gaps and maximise state pension entitlement; particularly following career breaks, maternity or long-term illness.

32. Defer income: Delay bonuses or dividends to the next tax year if advantageous for tax purposes.

33. Review your tax codes: Ensure your tax code reflects your current situation to avoid overpayments.

34. Optimise use of company benefits: Consider salary sacrifice schemes for pensions, electric cars, or cycle-to-work programmes.

35. Review offshore investments: Check compliance with UK tax rules for offshore investments and ensure tax efficiency.

36. Check how much cash you’re holding: Do you have too much, or not enough, available in cash? What interest rate are you earning on it? Consider using a cash management service to maximise your income on cash,* and spread across multiple institutions to maximise FSCS protection.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested. Equities do not provide the security of capital which is characteristic of a deposit with a bank or building society.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief is generally dependent on individual circumstances.

*Through SJP’s cash management service powered by Flagstone – please note this service is separate and distinct to those offered by St. James’s Place.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

More about Pension Carry Forward

You may be able to ‘Carry Forward’ unused Pension Annual Allowances from the previous three tax years. In 2022/23, the annual allowance was £40,000; it then rose to £60,000 for 2023/24, 2024/25 and 2025/26.

The maximum gross contribution you could make is £220,000. This assumes that you have been a member of a qualifying pension scheme for each of the past three tax years, and that you have not made any contributions. It also assumes you are not subject to annual allowance tapering, in any of the years, which can be applied to high earners.

Individuals with a ‘threshold income’ over £200,000 and an ‘adjusted income’ over £260,000 are subject to the tapered annual allowance. The reduction in allowance halts when ‘adjusted income’ exceeds £360,000, setting the annual allowance to a minimal £10,000 for pension savings that receive the full benefit of tax relief.

Broadly, ‘Threshold Income’ includes all taxable income received in the tax year, including rental income, bonuses, dividend, and other taxable benefits. From this you deduct any personal pension contributions to personal pension schemes. ‘Adjusted income’ includes all taxable income plus any employer pension contributions and most personal contributions to an occupational pension scheme.

To benefit from tax relief on personal contributions you also need earnings in the current tax year of at least the value of the contribution.

An additional rate taxpayer could capitalise on tax relief at up to 45% on their pension contribution, meaning theoretically up to £99,000 tax relief could be available through Carry Forward before Tax Year End on 5 April. The net cost of a £220,000 contribution could be as little as £121,000.

An expert wealth adviser can detail precisely what tax relief may be available to you, based on your individual circumstances.

Any tax relief above the basic rate must be claimed via HMRC.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

A new Capital Gains Tax (CGT) landscape

Capital Gains Tax UK rates increased last tax year, from 10% to 18% for lower rate taxpayers, and from 20% to 24% for higher and additional rate taxpayers. The rates for residential property remain at 18% and 24% respectively.

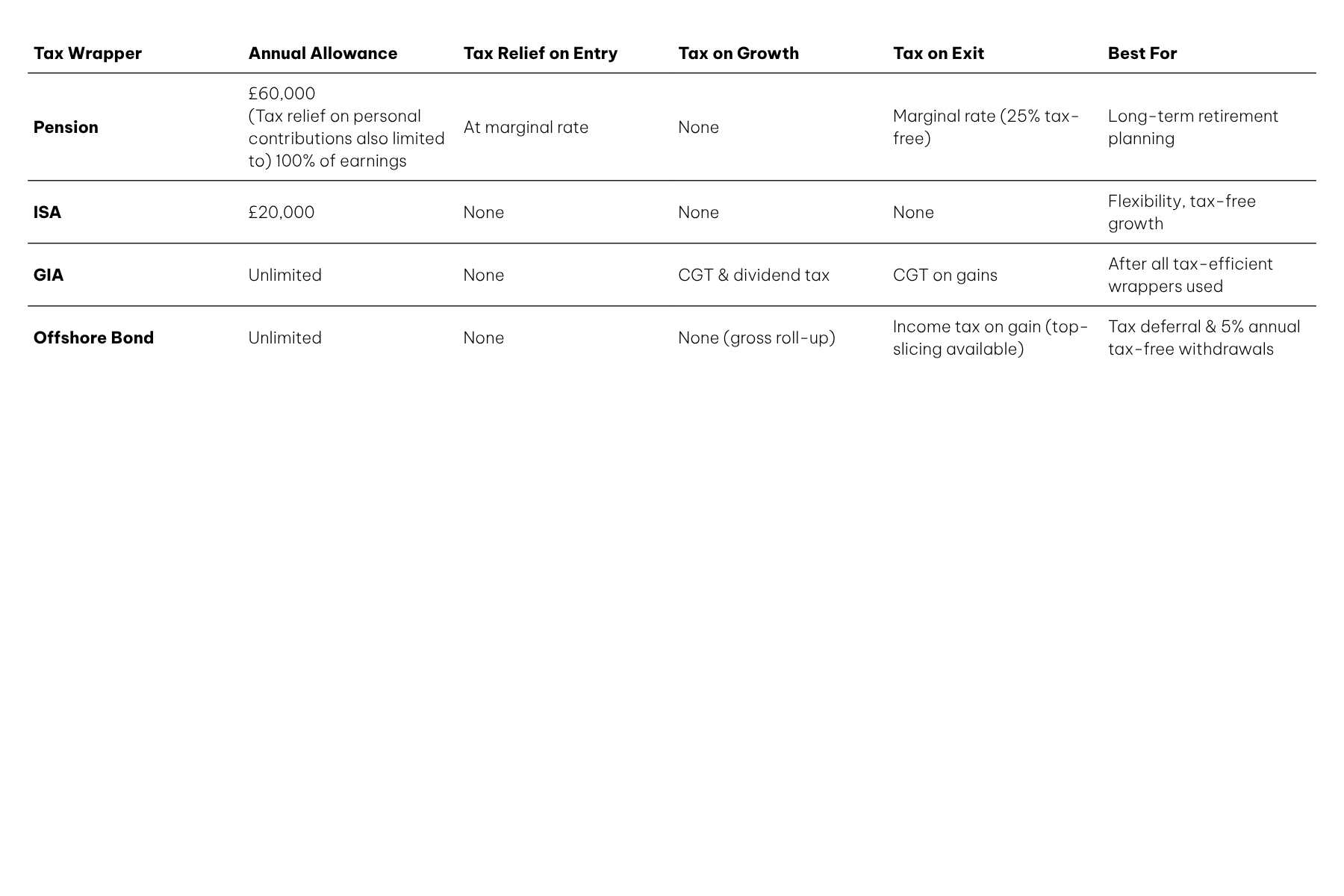

Each UK adult continues to benefit from an annual CGT exemption of £3,000. Beyond utilising your CGT exemption and your partner’s, you could work with an expert wealth adviser to examine whether Offshore Bonds offer a solution that is suitable for your individual circumstances.

Offshore investments can be really helpful for some investors; for example, if you’re expecting your tax rate to fall or you are planning to live outside of the UK at some point in the future. Our range of international investments offers a solution for investors who wish to invest regularly or by a lump sum, and provides access to a range of asset classes and currencies.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Currency movements may also affect the value of investments.

Start planning now – invest later. Obtain a bespoke financial plan, tailored to your unique objectives.

Book A Conversation